The Insolvency and Bankruptcy Code, 2016 (IBC), introduced a structured and time-bound mechanism for resolving the insolvency of corporate entities in India. One of the most important distinctions under the IBC is between Operational Creditors and Financial Creditors.

Understanding the difference between these two categories is crucial because their rights, remedies, and powers under the IBC are significantly different.

This article explains the meaning, legal position, rights, and differences between Operational Creditors and Financial Creditors under the IBC, with practical clarity.

Who Is a Creditor under the IBC?

A creditor is any person or entity to whom a debt is owed by the corporate debtor. Under the IBC, creditors are broadly classified into:

-

Financial Creditors

-

Operational Creditors

This classification determines who can initiate insolvency, who controls the process, and who has voting rights.

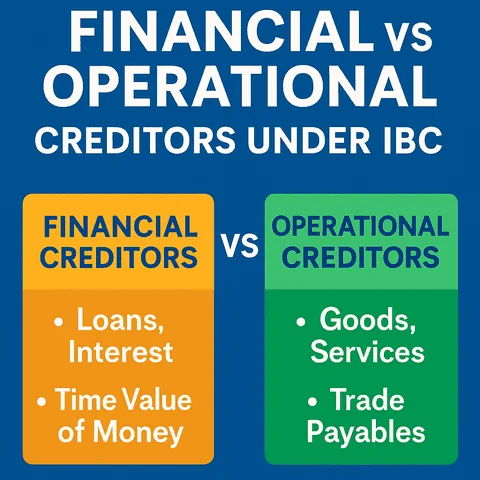

Who Is a Financial Creditor?

A Financial Creditor is a person to whom a financial debt is owed.

What Is Financial Debt?

Financial debt refers to money borrowed against the consideration for time value of money.

Common Examples of Financial Creditors:

-

Banks and financial institutions

-

NBFCs

-

Bondholders and debenture holders

-

Lenders who have disbursed loans

-

Persons who have provided credit facilities

The essence of financial debt is lending of money with interest or repayment obligation over time.

Who Is an Operational Creditor?

An Operational Creditor is a person to whom an operational debt is owed.

What Is Operational Debt?

Operational debt arises from:

-

Supply of goods

-

Rendering of services

-

Employment-related dues

-

Statutory dues payable to government authorities

Common Examples of Operational Creditors:

-

Suppliers and vendors

-

Service providers

-

Employees and workmen

-

Government authorities (tax, GST, PF, etc.)

Operational creditors are generally involved in the day-to-day operations of the company.

Key Differences Between Operational Creditor and Financial Creditor

| Basis | Financial Creditor | Operational Creditor |

|---|---|---|

| Nature of Debt | Financial debt | Operational debt |

| Time Value of Money | Present | Absent |

| Examples | Banks, lenders, NBFCs | Suppliers, vendors, employees |

| Right to File IBC | Yes | Yes |

| Threshold for Filing | As per prescribed minimum | Same threshold |

| Committee of Creditors | Member | Not a member |

| Voting Rights | Yes | No |

| Control Over CIRP | High | Limited |

Who Can Initiate Insolvency Proceedings?

Financial Creditors

Financial creditors can directly file an application for initiation of Corporate Insolvency Resolution Process (CIRP) on occurrence of default.

Key advantage:

-

No prior demand notice required

Operational Creditors

Operational creditors must first:

-

Issue a demand notice to the corporate debtor

-

Wait for the statutory response period

Only if the debt remains unpaid and undisputed can insolvency proceedings be initiated.

Role in Committee of Creditors (CoC)

Financial Creditors

-

Form the Committee of Creditors

-

Have voting rights

-

Decide key aspects such as:

-

Appointment of Resolution Professional

-

Approval of resolution plan

-

Liquidation decisions

-

Operational Creditors

-

Do not form part of the CoC

-

May attend meetings if their dues exceed a prescribed limit

-

Have no voting rights

This distinction makes financial creditors significantly more powerful under the IBC framework.

Treatment in Resolution Plan

-

Financial creditors have a priority role in negotiation and approval of resolution plans

-

Operational creditors must receive at least:

-

Amount payable in liquidation, or

-

Amount specified under the resolution plan

-

However, operational creditors cannot dictate terms of the plan.

Can Operational Creditors Be Treated at Par with Financial Creditors?

Judicial precedents have clarified that:

-

Financial creditors and operational creditors form separate classes

-

Differential treatment is permissible

-

Equality does not mean identical treatment

The rationale is based on the nature of debt and risk undertaken.

Which Creditor Is in a Stronger Position?

From an insolvency perspective:

-

Financial creditors are in a stronger position due to:

-

Voting rights

-

Control over CIRP

-

Commercial decision-making powers

-

However, operational creditors often use IBC as an effective pressure mechanism for recovery and settlement.

Strategic Considerations Before Filing IBC

Before initiating insolvency, creditors should consider:

-

Existence of dispute

-

Amount of default

-

Commercial viability of insolvency

-

Availability of alternative remedies

IBC is not meant to be used purely as a recovery tool, though it often leads to settlements.

Conclusion

The distinction between Operational Creditors and Financial Creditors under the IBC is fundamental to insolvency law in India. While both have the right to initiate insolvency proceedings, financial creditors enjoy greater control and decision-making authority.

Understanding this difference helps creditors choose the correct legal strategy and avoid procedural pitfalls before the NCLT.

FAQs – Operational vs Financial Creditor under IBC

Q1. Can an operational creditor become a financial creditor?

No, classification depends on the nature of debt, not the amount.

Q2. Do operational creditors get voting rights?

No, they do not have voting rights in the CoC.

Q3. Is a homebuyer a financial creditor?

Yes, homebuyers are treated as financial creditors under IBC.

Q4. Can government dues be operational debt?

Yes, statutory dues fall under operational debt.